Two-Wheeler Loan

Two-Wheeler Loan – Easy Bike Finance Online | DigitalLoanDost

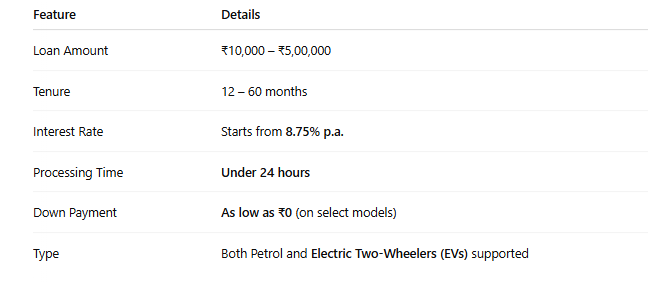

Looking to buy your dream bike or scooter in 2025? Whether it’s for daily commute, long rides, or convenience, a two-wheeler loan can make your purchase smoother than ever. At DigitalLoanDost, we help you get fast, flexible, and low-interest two-wheeler loans online, with minimal documents and 100% digital processing.

Why Choose DigitalLoanDost for Your Two-Wheeler Loan?

-

Instant approval & fast disbursal

-

Multiple loan offers from top banks & NBFCs

-

Low-interest rates starting at 8.75%

-

Easy documentation and 100% online processing

-

Transparent – no hidden charges

Two-Wheeler Loan Features

Get Finance for All Major Two-Wheelers

Whether it’s a stylish bike, daily-use scooter, or an eco-friendly EV – DigitalLoanDost covers all major brands:

-

Petrol Bikes: Royal Enfield, Honda, Yamaha, Bajaj, TVS, KTM

-

Scooters: Activa, Jupiter, Access 125, Vespa

-

Electric Two-Wheelers: Ather 450X, Ola S1 Pro, TVS iQube, Hero Vida

Eligibility Criteria

-

Age: 18 to 65 years

-

Income: ₹10,000/month and above

-

Employment: Salaried, self-employed, or business owner

-

CIBIL Score: Minimum 650+ preferred

Documents Required

-

Aadhaar Card / PAN Card

-

Address Proof (Electricity bill, rent agreement, etc.)

-

Salary slips (last 3 months) / Income proof

-

Bank statement (last 6 months)

-

Passport-size photo

How to Apply for a Two-Wheeler Loan?

- Fill Online Application

- Upload Basic Documents

- Get Instant Approval

- Loan Disbursed to Dealer or Bank Account

Pro Tip: You can get 100% bike loan on select models with zero down payment.

Frequently Asked Questions

What is the interest rate for a two-wheeler loan in India?

Most two-wheeler loans start at 8.75% p.a. and can go up to 28% depending on your credit score, bike model, and loan provider.

Can I get a bike loan with a low CIBIL score?

Yes, some NBFCs and lenders offer bike loans for CIBIL scores below 650, but you may face a higher interest rate or require a co-applicant.

Can I get a two-wheeler loan with zero down payment?

Yes, many lenders including banks and NBFCs offer zero down payment bike loans on select models and brands.

Are electric two-wheelers eligible for loans?

Absolutely. EV two-wheeler financing is booming with low-interest rates and government subsidies. Many banks now offer exclusive EV loan schemes.

How much loan can I get on a bike?

You can get up to 100% of the on-road price as a two-wheeler loan, subject to eligibility and model.

Is it better to take a two-wheeler loan from a bank or NBFC?

Banks usually offer lower interest rates, while NBFCs provide faster disbursal and flexible approval even for lower credit scores. You can compare both at DigitalLoanDost.