Gold Loan

Instant Gold Loans in India – Secure Your Gold, Unlock Your Dreams!

Need quick funds without the hassle of paperwork or long approval times? Get an instant gold loan from DigitalLoanDost – a smart, secure, and stress-free way to access money using your gold jewelry.

What is a Gold Loan?

A gold loan is a secured loan where you pledge your gold ornaments or coins as collateral in exchange for a lump sum of money. It’s one of the fastest and safest ways to raise funds for emergencies, business needs, medical expenses, education, or weddings.

Why Choose DigitalLoanDost for Your Gold Loan?

-

🔒 100% secured gold storage

-

🚪 Doorstep gold loan service in selected cities

-

🧾 Transparent process – no hidden charges

-

⏱️ 30-minute approval and disbursal

-

📉 Competitive gold loan interest rates

-

100% Online Process: Apply from the comfort of your home.

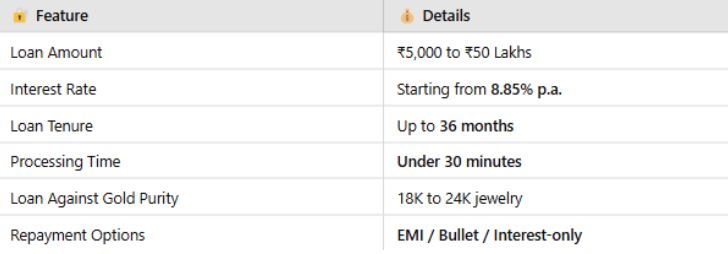

Features & Benefits of DigitalLoanDost Gold Loan

Why Gold Loans Are Booming in India

With rising gold prices and increasing demand for quick liquidity, gold loans in India have become a top choice for millions of families and small business owners. As per recent RBI reports, India saw a 32% growth in gold loan demand in the last fiscal year alone!

Disbursal in minutes, not days

Gold stays safe and insured

Flexible repayment options

No impact on credit score

Eligibility Criteria for Gold Loan

-

Applicant must be 18 years or above

-

Gold purity should be 18 to 24 karat

-

Valid KYC documents (Aadhaar, PAN, etc.)

-

No income proof required!

Required Documents

-

Aadhaar Card

-

PAN Card

-

1 Passport-size photo

Note: No CIBIL check or income proof needed – just walk in with your gold!

Who Should Apply for a Gold Loan?

- Individuals needing emergency medical funds

- Business owners looking for working capital

- Farmers needing seasonal support

- Students or parents looking for education loans

- People facing temporary financial crunches

Is My Gold Safe?

Absolutely. We use bank-grade vaults, CCTV surveillance, and insurance coverage for every pledged ornament. Your gold remains untouched, secure, and 100% retrievable

Frequently Asked Questions

What is the current gold loan interest rate in 2025?

Gold loan interest rates in India for 2025 start as low as 8.85% p.a., depending on the lender and the loan amount. At DigitalLoanDost, we offer competitive rates with flexible repayment plans. Always compare interest rates before applying.

How much gold loan can I get for 10 grams?

For 10 grams of 22K gold, you can get a loan amount between ₹45,000 to ₹56,000, depending on gold purity, rate per gram, and the lender's LTV (Loan-to-Value) ratio.

How fast is the gold loan disbursal process?

At DigitalLoanDost, you can get your gold loan approved and disbursed within 30 minutes. Just walk in with your gold and KYC documents – it’s that simple!

What are the repayment options for gold loans?

You can choose from multiple repayment options: - EMI (Equated Monthly Installment), - Bullet repayment (full payment at the end), - Interest-only payment with principal later.

Is my gold safe during the loan period?

Yes, absolutely! Your gold is stored in bank-grade lockers, under 24/7 CCTV surveillance, and is fully insured for the loan tenure. You get it back in the same condition.

What is the minimum and maximum loan amount I can get?

You can avail a gold loan starting from ₹5,000 up to ₹50 Lakhs, depending on the gold weight and purity. DigitalLoanDost caters to both small and large loan needs.