Business Loan

Business Loan in India – Fuel Your Growth with DigitalLoanDost

India’s entrepreneurial spirit is booming—with over 1.4 million startups, MSMEs, and small businesses seeking flexible finance solutions to grow faster. A business loan is a powerful financial tool designed to meet your business needs such as working capital, expansion, equipment purchase, or handling cash flow gaps.

What is a Business Loan?

A business loan is an unsecured financial product offered to self-employed individuals, entrepreneurs, and MSMEs to meet their business-related expenses. Whether you’re launching a new venture or scaling an existing one, a business loan helps you achieve your goals without diluting ownership or equity.

Why Choose DigitalLoanDost?

-

Tailored for Indian Businesses – From startups to traders

-

Zero Hidden Charges – Transparent process

-

100% Paperless – No branch visits

-

Personalized Loan Offers – Based on your profile

-

Trusted Network of Lenders – HDFC, ICICI, Bajaj, and more

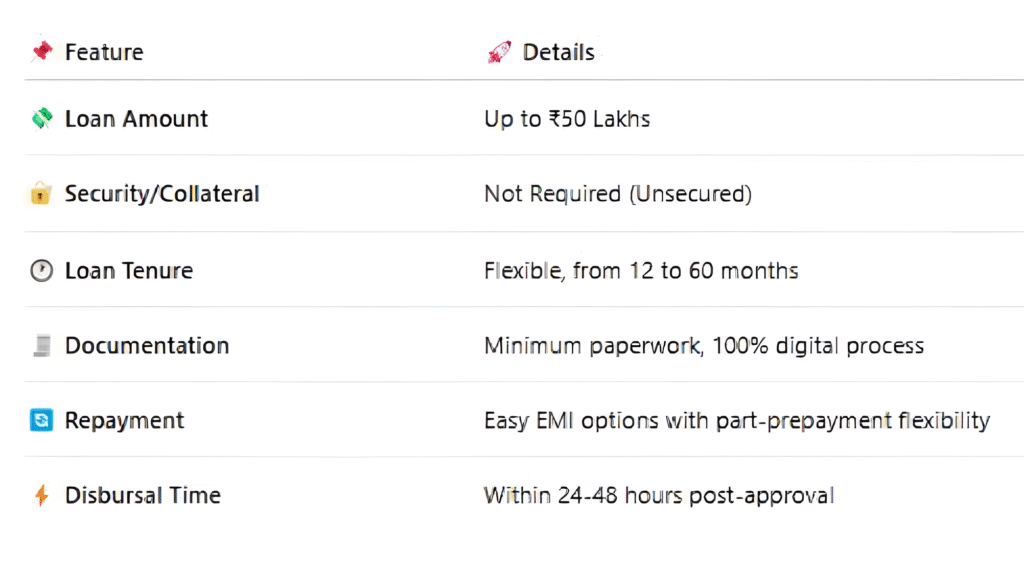

Features & Benefits of Our Business Loans

Business Loan Eligibility Criteria

-

Age: 21 to 60 years

-

Indian citizen, running a business for minimum 2 years

-

Valid bank account and GST registration

-

inimum turnover: ₹10 Lakhs/year

-

Good credit score (CIBIL 685+)

Required Documents

-

PAN Card / Aadhaar Card

-

Bank statements (last 6–12 months)

-

GST details or ITR filings

-

Business proof (Shop Act, Udyam, etc.)

-

Address & ID proof of the business owner

How to Apply for a Business Loan Online?

Applying with DigitalLoanDost is a breeze:

-

Fill out a simple online loan application form

-

Upload scanned copies of your documents

-

Choose your loan amount & tenure

-

Get instant approval and funds in your bank!

Who Should Apply for a Business Loan?

-

Retailers & Shop Owners

-

E-commerce Sellers

-

Traders & Wholesalers

-

Professionals (Doctors, CAs, Designers, etc.)

-

Manufacturers & Exporters

-

Freelancers & Service Providers

Frequently Asked Questions

What is the maximum business loan amount I can get in India?

You can avail up to ₹50 lakhs, depending on your turnover, CIBIL score, and repayment capacity.

Can I get a business loan without collateral in India?

Yes, many NBFCs and banks offer unsecured business loans—no collateral required, just a good credit profile and business track record.

What is the interest rate for business loans?

Interest rates start from 10.5% per annum, depending on the lender, business type, and tenure.

How long does it take to get a business loan?

With DigitalLoanDost’s online process, you can get loan approval in just 24 hours and disbursal within 48 hours.

Can startups get business loans?

Yes, early-stage startups can get loans through startup-specific funding programs, business credit cards, or secured loans using personal guarantees.

How is a business loan EMI calculated?

EMI is calculated based on the loan amount, interest rate, and tenure. You can use our business loan EMI calculator to check your monthly payments.