Education Loan

Education Loan in India – Empower Your Future with DigitalLoanDost

Whether you’re planning to study in India or abroad, your dreams should never be limited by finances. At Digital Loan Dost, we help you access the best education loan in India 2025 with fast online approval, flexible EMIs, and minimal paperwork. We bring you customized student loan options, whether it’s for an MBA, engineering, medicine, or skill-based training.

Your future starts here. Begin your education loan online apply process today.

What is an Education Loan?

An education loan is a financial product designed to support students in funding their academic expenses. It covers tuition fees, hostel charges, books, travel expenses (for overseas studies), and even living costs. With a structured repayment plan and a moratorium period (typically 6–12 months post-study), it ensures minimal pressure during your education.

Whether you’re seeking a student loan without collateral or one tailored for an MBA program, we’re here to simplify the journey.

Types of Education Loans DigitalLoanDost Offering

-

Undergraduate Loans – For bachelor’s programs in India and abroad.

-

Postgraduate Loans – Includes education loan for MBA, MS, MTech, and more.

-

Study Abroad Loans – For international university programs; also includes visa/travel insurance.

-

Skill Development Loans – For short-term or diploma courses.

-

xecutive Education Loans – For working professionals attending part-time MBAs or upskilling.

-

Secured & Unsecured Loans – Choose between collateral-free student loans and property-backed options.

Eligibility Criteria for Education Loan

To apply for an education loan online in India, you need:

-

Indian citizenship

-

Age between 18 to 35 years

-

Admission to a recognized institution (India or abroad)

-

A co-applicant (parent/spouse/guardian) with a steady income

-

For student loan without collateral, the course and institution must fall under approved premium categories

Documents Required for Education Loan

-

PAN & Aadhaar Card (Student & Co-applicant)

-

Recent passport-size photographs

-

Admission letter or offer letter

-

Estimated course cost (fee structure)

-

Income proof (Salary slips, ITRs, bank statements of co-applicant)

-

Passport & Visa (for education loan for abroad studies)

-

Collateral documents (only if applying for secured loans)

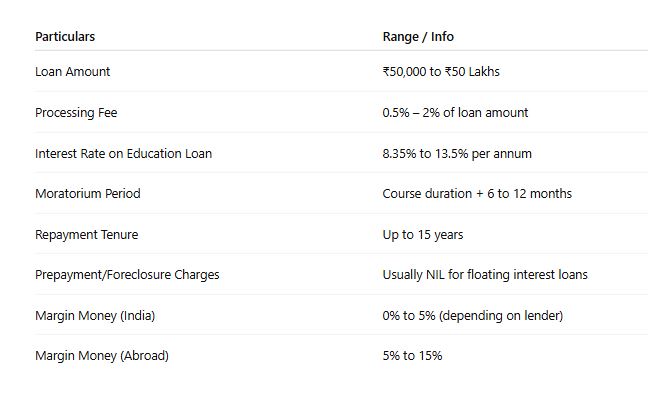

💰 Fees & Charges

Education Loan Online Apply – How It Works?

-

Check Your Eligibility

-

Submit Documents Digitally

-

Compare Offers from Top Banks & NBFCs

-

Get Sanctioned Instantly

-

Funds Disbursed to Institute/You Directly

-

No paperwork. No running to branches. Just fast, transparent processing.

Frequently Asked Questions

Can I get an education loan without collateral?

Yes. Many top banks and NBFCs offer student loans without collateral up to ₹40 lakhs for top institutions in India and abroad.

What is the interest rate on education loan this year?

Tthe interest rate on education loan ranges from 8.35% to 13.5%, depending on the lender and course.

Am I eligible for an education loan before admission confirmation?

Absolutely! You can pre-apply with an entrance exam score or offer letter to secure quick sanction.

What documents are required for an education loan for MBA abroad?

Admission letter, income proof of co-applicant, passport, visa, academic history, and bank statements are generally required.

Which is the best education loan in India?

Loans from SBI, HDFC Credila, ICICI, Axis Bank, and NBFCs via DigitalLoanDost offer the best rates and flexible terms for 2025.